Productive investment as a driver of growth: the challenge of boosting business investment

Private productive investment declined significantly in Spain in the wake of the pandemic and, unlike GDP and other macroeconomic variables, is yet to recover pre-pandemic levels. Boosting investment is key for increasing productivity and the potential growth of the Spanish economy.

Productive investment is essential for sustaining economic growth over the medium and long term. Since the pandemic, public investment in Spain has grown significantly. By contrast, private investment has lagged behind. It is therefore important to understand how productive business investment has performed in recent years, identify the factors holding it back and explore ways to boost it.

DID YOU KNOW…?

Productive investment, which may be private or public, involves spending on assets that increase productive capacity. In practice, this means total investment excluding investment in housing. Specifically, productive investment includes spending on assets such as:

- other construction and real estate (for example, offices and facilities);

- equipment (for example, machinery and vehicles);

- intangible assets, which include investments in assets that lack physical form, such as software, databases and patents.

Productive investment – which excludes residential investment – is essential to sustain economic growth over the medium and long term

How has productive investment fared since the pandemic?

Chart 1

GDP HAS RECOVERED MORE ROBUSTLY IN SPAIN THAN IN THE EURO AREA

SOURCE: INE, ECB and Bureau of Economic Analysis.

In 2019, the year before the pandemic, productive investment accounted for 15% of GDP in Spain. Although the Spanish economy has grown more than other European economies since end-2019 (Chart 1), private productive investment has had a sluggish recovery in Spain and remains below pre-pandemic levels (Chart 2). This stands in contrast to the euro area, where private productive investment is close to its pre-pandemic levels, and the United States, where it has seen very strong growth in recent years.

Conversely, as shown in Chart 3, public investment in Spain surged after the pandemic, partially offsetting the decline it experienced after the 2008 global financial crisis. The strong growth in Spanish public investment in recent years, which has outpaced that of the euro area and the United States, appears to be at least partly driven by the roll-out of the Next Generation-EU (NGEU)![]() programme in Spain.

programme in Spain.

Since 2019 firms’ productive investment as a share of GDP has declined, unlike public investment

Chart 2

PRIVATE PRODUCTIVE INVESTMENT HAS NOT RETURNED TO PRE-PANDEMIC LEVELS

SOURCE: INE, ECB and Bureau of Economic Analysis.

Chart 3

PUBLIC INVESTMENT HAS GROWN SIGNIFICANTLY SINCE 2021

SOURCE: INE, ECB and Bureau of Economic Analysis.

In any event, public investment accounts for a relatively small part of total productive investment in the country (20.8% in 2024). Therefore, driving a stronger recovery in business investment is crucial for ensuring sustainable growth over the medium term.

How have the various components of productive investment behaved?

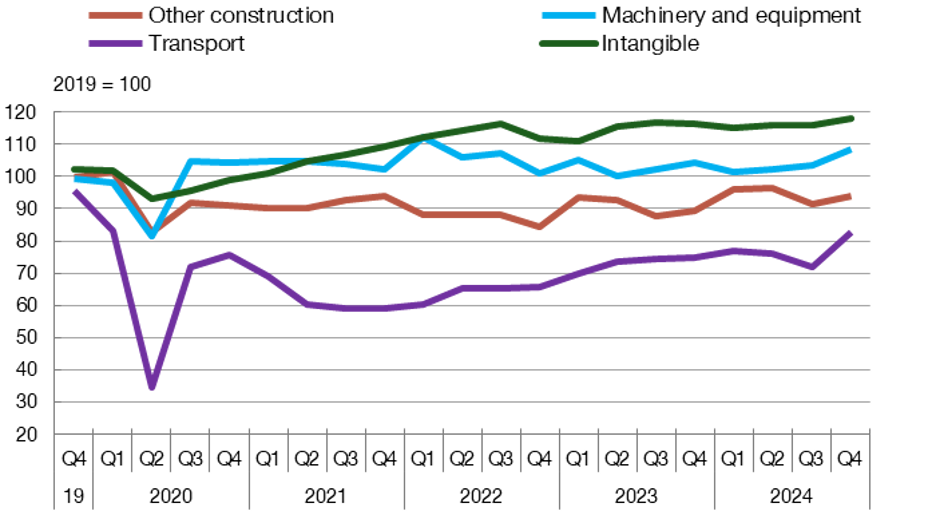

As can be seen in Chart 4, not all components of productive investment have followed the same pattern in recent years. The most significant growth since the pandemic has been in intangible investment, which is essential, among other aspects, for the digital transition of the economy. At end-2024 intangible investment in Spain was 17% higher than in 2019 (compared with a 28% rise on average for the euro area as a whole). Even so, it accounted for 25.8% of total productive investment, a slightly lower share than in the euro area (26.8%).

Chart 4

PRODUCTIVE INVESTMENT BY COMPONENT

SOURCE: INE.

NOTE: Machinery and equipment excludes transport.

Conversely, despite recovering in 2024, investment in transport equipment is still 17% below its pre-pandemic levels, lagging behind such investment in the euro area (which is 7% down on pre-pandemic levels).

Investment in machinery and equipment has only just recovered pre-pandemic levels, while investment in construction other than housing has yet to do so.

Which factors make it more difficult for firms to invest?

Figure 1 summarises the factors that can limit productive investment and how they affect investment decisions.

Figure 1

OBSTACLES TO INVESTMENT

To better understand the current situation in Spain, a recent edition![]() of the Banco de España Business Activity Survey (EBAE

of the Banco de España Business Activity Survey (EBAE![]() ) asked 6,500 firms how much their investment had changed in recent quarters and what factors might be hindering it.

) asked 6,500 firms how much their investment had changed in recent quarters and what factors might be hindering it.

In general, the survey shows that investment varies greatly depending on the characteristics of each firm. Larger and more productive firms reported higher increases in investment. By contrast, firms with substantial idle capacity (for example, due to a sharper decline in demand) reported lower levels of investment.

Chart 5 shows the relative importance of the various factors that shape business investment. According to the respondent firms, uncertainty about economic policy, outsourcing (which shifts investment to the subcontractor) and business regulation are the three main factors limiting productive investment.

Chart 5

OBSTACLES TO INVESTMENT ACCORDING TO SPANISH FIRMS

SOURCE: Banco de España Business Activity Survey (EBAE![]() ).

).

NOTE: Respondent firms’ reply to the question: What effect have the following factors had on your firm’s investment decisions over the past 12 months? The chart shows the percentage of firms reporting a negative or very negative impact of each of these factors on their investment decisions. This survey was conducted between 13 and 27 May 2024

In short, private productive investment has struggled to bounce back in recent years and now accounts for a lower share of GDP than before the pandemic. Despite the buoyancy of public investment, the total productive investment rate stood at 13.6% of GDP (over 1 pp less than in 2019).

How can obstacles to investment be reduced? The results of the EBAE suggest that business investment could be fostered by reducing uncertainty about economic policy (both domestically and internationally), avoiding onerous regulation and promoting an environment that does not hinder firm growth. Chapter 2 of the Banco de España Annual Report 2023![]() includes some additional recommendations that could help boost business investment in Spain.

includes some additional recommendations that could help boost business investment in Spain.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.